Tobacco taxation

Raising taxes on tobacco

Evidence shows that significantly increasing tobacco excise taxes and prices is the single most effective and cost-effective measure for reducing tobacco use. Raising taxes on tobacco products which lead to increases in their price makes tobacco less affordable. When tobacco becomes less affordable people use it less and youth initiation is prevented. Because youth and low-income groups are more responsive to increases in tobacco prices, they disproportionately enjoy the health and economic benefits of quitting and not starting.

Saving lives with tobacco taxes lessens the enormous healthcare burden and economic losses that result from tobacco-related disease. Tobacco taxation is also relatively inexpensive to implement and generates significant revenues over the short and medium term.

WHO supports all its Member States in using tobacco taxes to meet their health, revenue and equity objectives

Source : https://www.who.int/activities/raising-taxes-on-tobacco

Tobacco taxation

Legal Basis

- Article 23 of the National Health Promotion Act (Imposition, Collection, etc. of Charges for National Health Promotion)

- Article 52 (Tax Rates) and 151 (Tax Bases and Tax Rates) of the Local Tax Act

- Article 1.2.6 of the Individual Consumption Tax Act (Taxable Objects and Tax Rates)

- Article 17 of the Enforcement Rules of the Tobacco Business Act (Tobacco Subsidy Fund)

- Article 11 of the Enforcement Decree of the Act on the Promotion of Saving and Recycling of Resources (Standards for Calculation of Waste Charges)

- Article 30 of the Value-added Tax Act (Tax Rate)

Tobacco taxation rates in South Korea

The total taxation rate of tobacco is 73.8% of tobacco (cigarettes) retail prices, which is close to 75% tax share which is recommended by the WHO FCTC. Tobacco products in Korea are subject to seven types of taxes and charges, and e-cigarettes are subject to six types of taxes and charges. The six types of consumption taxes and charges are specific taxes, and value-added taxes are levied in the form of ad valorem taxes.

Tobacco consumption tax, local education tax, individual consumption tax, and value-added tax are taxes that are used as general financial resources.

| Tax | Cigarettes (per 20 sticks) |

HTPs (per 20 sticks) |

E-cigarettes (per 1ml of e-liquid) |

Tax System |

|---|---|---|---|---|

| Tobacco excise tax | 1,007 | 897 | 628 | Specific Tax |

| Local education tax | 443 | 395 | 276 | |

| Individual consumption tax | 594 | 529 | 370 | |

| Tobacco farming support fund | 5 | - | - | |

| Health promotion charge | 841 | 750 | 525 | |

| Health promotion charge | 841 | 750 | 525 | |

| Waste management charge | 24.4 | 24.4 | 1.22 | |

| Value-added tax | 409 | 409 | 409 | Ad valorem Tax |

| Total tax(A) | KRW 3,323.4 | KRW 3,004.4 | KRW 2,209.22 | |

| Retail price(B) | KRW 4,500 | KRW 4,500 | KRW 4,500 | |

| Tax share(A/B) | 73.8% | 66.8% | 49.1% |

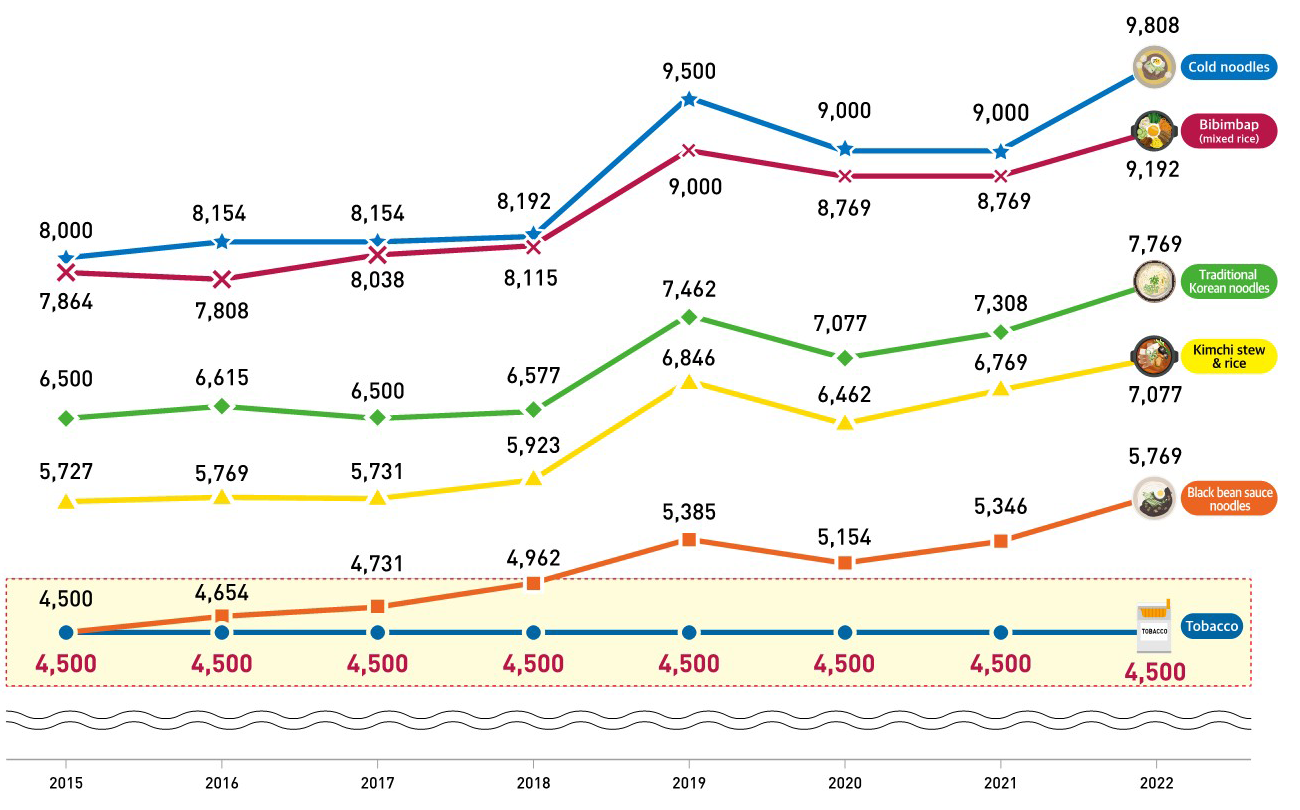

Tobacco prices in South Korea

After increasing tobacco prices in 2015, tobacco prices remain unchanged up until 2023. However, throughout the years, actually consumer purchasing power has increased, so in order to make tobacco less affordable, tobacco taxation policy should be revised according to current income levels and inflation rates.

- See TOBACCO CONTROL FACT SHEET No. 48 ‘Tobacco Taxation’ & INFOGRAPHIC ‘Current status of tobacco prices in Republic of Korea’